Make life at work better.

Tivian’s powerful platform provides the tools and integrations you need to transform the employee experience. Whether used alone or together, our products provide the data-driven insights and personalized content designed to make life at work better.

Trusted by

Tivian is a leader in Employee Experience with over twenty years of expertise working with Europe’s largest companies. Our acquisition of GuideSpark creates a global platform with over 1,000+ Enterprise customers.

Everything is changing.

As business changes at lightning speed, it has become more important than ever to attract and retain high-performing employees. Some are innovators, others simply ‘get it done.’ But they all want what our partner Deloitte calls an “irresistible organization.” Provide that experience or risk losing your best people.

Tivian has the solution.

Tivian’s software platform makes it easy to listen to your employees, identify key trends and insights, and take the actions that make the workplace better. The result is an energetic, focused team that can handle anything.

Even change.

The "Great Resignation" by the numbers:

Insights + Action.

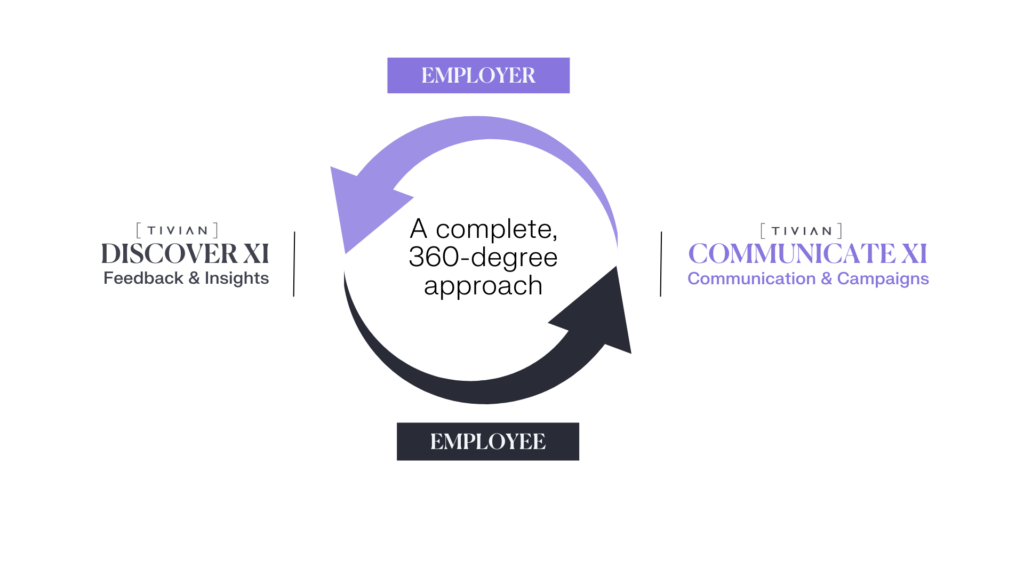

Tivian's software is a unique

360-degree solution

TRADITIONAL SURVEYS ARE DEAD.

Listening is no longer enough. You have to act to improve the employee journey. Other employee solutions focus only on feedback and surveys, or communication tools like video, email, or SMS. Tivian goes beyond, with a complete, 360-degree approach to the Talent Strategy Experience that uncovers insights and delivers action. Welcome to Employee Experience Intelligence, or XI.

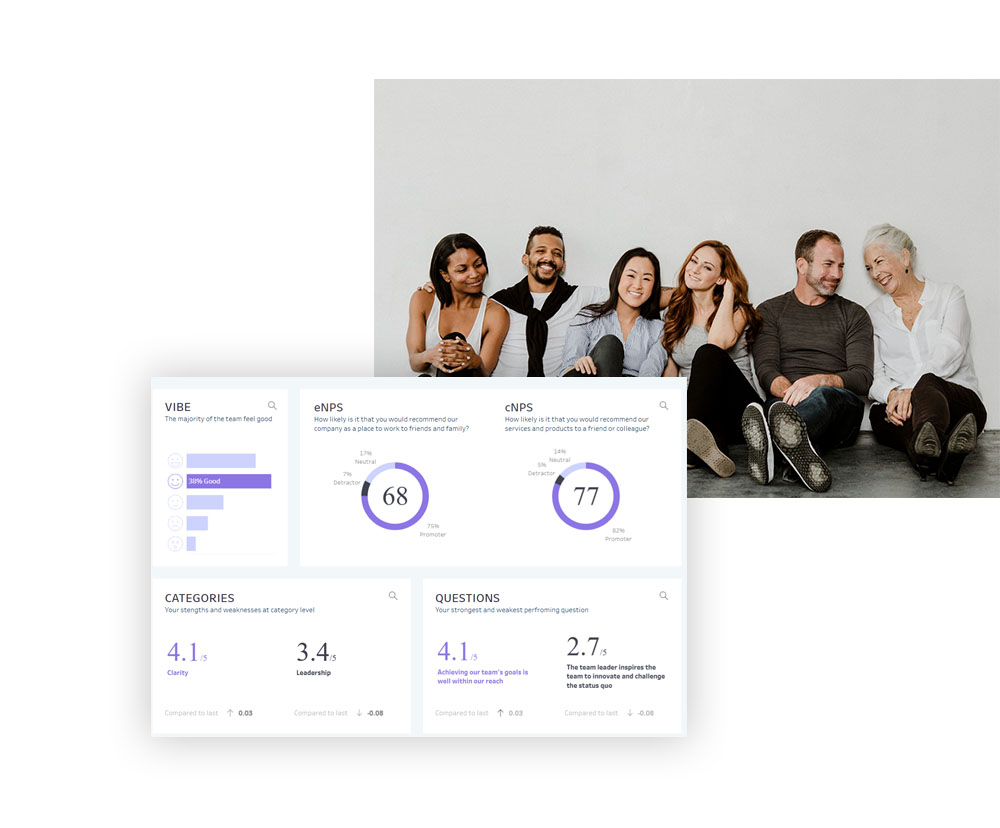

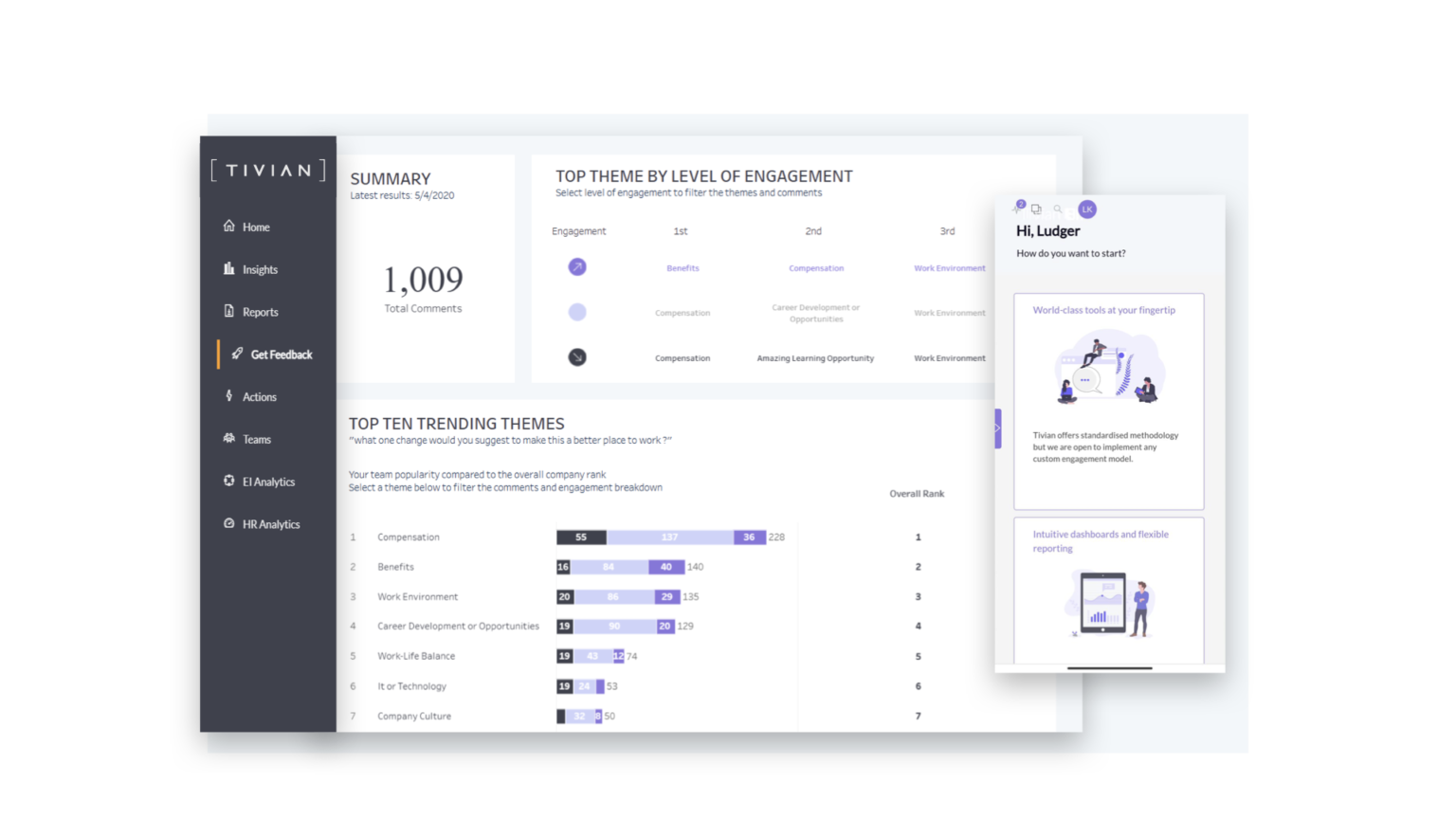

Your company needs insight to deliver action, but the speed of change makes it hard to get answers. With technologies like knowledge engineering and artificial intelligence, DISCOVER XI finds the data you need to discover new trends, spot trouble, and nurture talent. Who’s performing? Who needs supporting? Which key drivers have the greatest impact?

DISCOVER XI finds the answers.

Plan and track campaigns with personalized content designed to inspire change. COMMUNICATE XI helps employees feel valued by delivering the messages they need, when they need them. Build campaigns like a marketer and engage your team with timely, lively content that keeps them focused, aligned, and yes, even entertained!

COMMUNICATE XI cuts through the noise.

Two complex needs. One simple solution.

Use Tivian's solutions to build trust, because you can't solve what you don't understand.

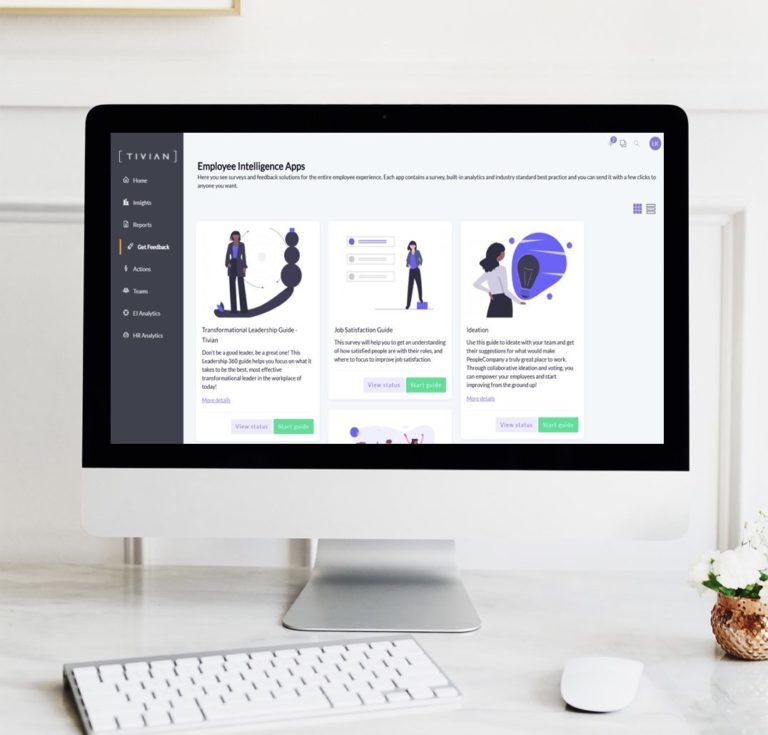

In times of staggering change, every organization encounters unique challenges along the employee journey. Tivian offers a menu of program-specific solutions that can help solve these issues. Discover trends, key drivers, and early warnings signs with annual and quarterly pulses and employee lifecycle management, all from one easy-to-use platform. Then, communicate with dynamic, personalized content that speaks directly to these discoveries.

- Run intelligent surveys, analyze data, and take action

- Use targeted data to deliver personalized content

- Explore a library of customizable solutions

- Identify key drivers using AI and machine learning

Build a custom program or leverage one of our pre-built solutions.

Leadership

360

Nurture leaders at all levels of your organization with our easy-to-use, award-winning tech solution for leadership development.

Organizational Effectiveness

Establish an engaging workplace culture that will boost retention, drive talent acquisition, and improve the employee experience.

Employee

Lifecycle

Get a holistic look at your employee experience – from onboarding to offboarding – to help you make the biggest impact for your workforce.

Inclusive Leadership

Winner of the 2021 HR Tech Award for Best DEI-Enabling Solution. Build a more inclusive company culture by discovering the biases that can hold a company back.

Employee

Wellness

Understand how ongoing communication and honest feedback encourage greater engagement with your team and overall employee wellness.

Benefits &

Total Rewards

Help employees understand the benefits and rewards packages available to them, and encourage program adoption and participation.

Leadership 360

Nurture leaders at all levels of your organization with our easy-to-use, on-demand solution for leadership development.

Workplace Alignment

Establish an engaging workplace culture that will boost retention, drive talent acquisition, and improve the employee experience.

CultureQuest

Winner of the 2021 HR Tech Award for Best DEI-Enabling Solution. Build a more inclusive company culture by discovering the inequalities and biases that can hold a company back.

Talent Management

Our talent solution helps foster a culture of 360-degree feedback, encourages goal alignment, and drives better employee-leadership conversations.

Employee Engagement

Employee engagement leads to better business performance, which is why it's crucial to measure, analyze, and continuously improve your employee experience.

Financial Education

Model transparency by giving employees a deeper understanding of the fundamentals of compensation and equity that affect them.

Company Onboarding

Craft a better onboarding experience that speeds up time to performance, kicks off an employee experience, and streamlines key HR processes.

Benefits & Total Rewards

Help employees understand the benefits and rewards packages available to them, and encourage program adoption and participation.

Wellness

Our wellness solution helps alleviate the physical and psychological challenges of the modern workplace through education and inspiration.

Three steps to driving employee engagement with Tivian.

Collect

Find the issues

Conduct research with our flexible platform. Dynamic dashboards and panels are adaptable to suit any employee group.

Configure

Democratize the data

Study the issues based on data, not hunches. Learn the trends and find the problems quickly. Then fix them.

Communicate

Deliver improvement

Engage and upskill your workforce with dynamic, personalized content like video, email, SMS, and infographics.

Tivian Studios makes content that sizzles.

Our in-house creatives make it easy to deliver immersive, branded experiences for your team. Over the years, we’ve partnered with numerous Fortune 500 companies to create communications designed to engage. From custom scripts to dynamic videos, break room posters to infographics, Tivian Studios knows employee content.

The stakes have never been higher.

Tivian understands that the workplace has totally transformed. Covid accelerated a trend towards remote working, created a demand for shorter product runways, and overloaded employees with new platforms and technologies. The traditional structure of the workplace seemed to vanish overnight. Now, companies are struggling to regain a sense of normalcy and return to “business as usual.”

Guess what? It may never happen.

Millions of US employees have quit their jobs and the trend doesn’t indicate it’s going to stop. That is, until companies recognize this sea-change and do the work to understand it.

At Tivian, we understand the problem. We also believe the answers are right in front of you. They’re on that Zoom call you just wrapped up. They’re driving the forklift in the warehouse. They’re running your global operations.

They’re your people.

The time is now.

How many top-performing employees are leaving your organization because they don’t feel a sense of purpose? How many of them are moving to your competition? How much is employee turnover costing you every day? A lack of trust within your organization may have a hidden price you can no longer afford to ignore.

Our software technology provides the insight behind what makes employees not just stay, but stay engaged. Then we help companies make it clear they listened, with relevant, useful content. It’s a process that builds trust and creates meaning.

It’s also the foundation of XI, a 360-degree approach that helps companies retain and nurture talent.

Turn the Great Resignation into the Great Attraction. Schedule a call with Tivian now to learn how our software solutions can help transform your employees’ experience.